Cryptocurrency is a Fairytale

And not the kind with a happy ending

Many liberty-minded people will spend hours debating the technical advantages of one form of cryptocurrency over another, while completely ignoring the threat posed to both cryptocurrency and liberty by central bank digital currency (CBDC).

This is a big mistake.

The blockchain technology that underpins Bitcoin and other cryptocurrencies is usually marketed as allowing security and privacy. But with a CBDC, that same technology makes it possible for every penny of every transaction to be recorded, tracked, and potentially thwarted by a central authority.

CBDCs that would function as legal tender are being developed by most major countries, with some entities (notably the European Union) considering the complete abolition of cash. At the global level, the International Monetary Fund recently announced that a previously unknown consortium of public and private institutions called the Digital Currency Monetary Authority has developed a digital currency called Unicoin for use anywhere on the planet.

Given this level of interest, and the fact that the authorities do not permit states or individuals to print their own paper currency, why does anyone expect them to tolerate competition to their CBDCs?

Crypto advocates claim that the decentralized nature of blockchain technology prevents it from being snuffed out. But this is magical thinking. Even Bitcoin - the most well known cryptocurrency - never broke into the mainstream. If the entire asset class were declared illegal, most of the existing user base would abandon it faster than the Dutch ditched their tulip bulbs. In fact, like Tulipmania, it would be a classic example of a bubble bursting: most of the current owners would try to sell their supply at the same time. In the absence of any demand, the value would drop to nothing. Unlike tangible assets, crypto has no inherent worth whatsoever, so it could - and probably would - go all the way to zero.

Meanwhile, John Q. Public, who usually ignores anything he doesn't understand, still hasn't grasped that CBDCs offer governments and international organizations heretofore unimaginable control over his daily life. The Bank of England has already enthusiastically explained how CBDCs could be programmed to prevent the purchase of “socially harmful” items (i.e., anything the government decides you shouldn’t have).

For a real-world example of what this could mean, consider how Canadians who supported the Freedom Convoy protests were doxxed and had their bank accounts frozen. Once Canada implements the “digital dollar,” those PR headaches won’t happen, because donations to groups protesting government policies will be automatically blocked before they can occur in the first place.

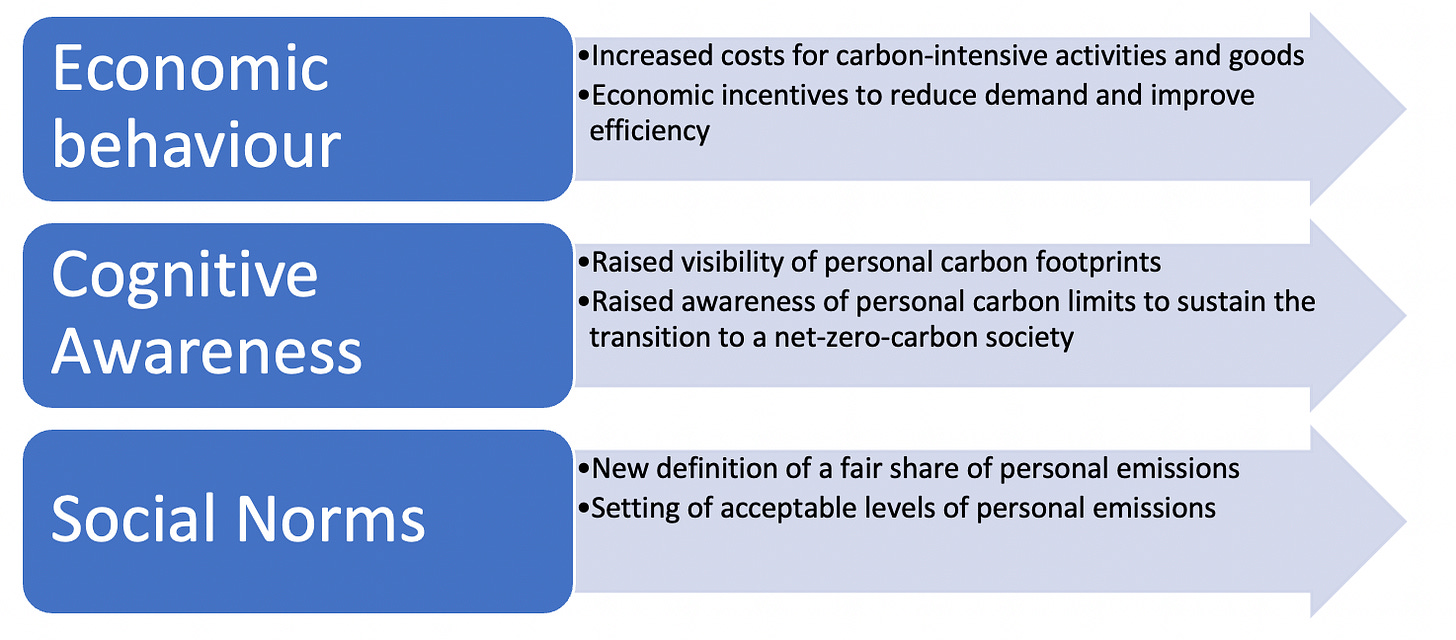

In case you think you don’t have anything to worry about because you don’t plan to support protests or buy anything socially harmful, you may want to think again. The World Economic Forum has insinuated that CBDCs would be the key to forcibly altering public behavior in the name of climate change. The idea is that you'd be allotted a monthly “personal carbon allowance,” and your consumption of electricity, meat, gasoline, and other products would be subtracted from your allowance. Hoping to grill some burgers on the 4th of July? Enjoy them, because you might not have enough carbon allowance left to run your air conditioner for the rest of the summer.

If this sounds far-fetched, check out the Svalna app. It is intended for use in Sweden, but is available for iPhone and Android worldwide. According to the website, its “unique carbon calculator measures your carbon footprint based on what you actually consume. Connect with eID and calculate your climate impact in real time.”

Closer to home, cities like New York have committed to reducing the carbon footprint of their citizens, and even started tracking food purchases. Given the way that climate change is already being used to justify what Human Rights Watch calls “authoritarian environmentalism,” it would be naive not to foresee policymakers pushing for these voluntary efforts to become mandatory.

Even if CBDCs aren’t tied to Personal Carbon Allowances (at least, not initially), there are no circumstances under which policymakers would tolerate competition from grassroots alternatives that would negate the potential power afforded by CBDCs. It’s only a matter of time before Bitcoin and the other cryptocurrencies are either absorbed into CBDCs or criminalized outright.

Cryptocurrency could be thought of as a Trojan horse, but a better analogy might be the story of Hansel and Gretel. From the outside, the evil witch’s house of gingerbread and candy looks like a libertarian dream of private transactions and decentralized economic freedom. But once you're locked inside, you realize that it’s a dystopian nightmare of constant surveillance and technocratic serfdom.

Which is why we should not get locked in. Let a thousand currencies bloom, I say.